MARKETS:

Written By: Sergio Lopez Elizondo, Junior Analyst

Overview

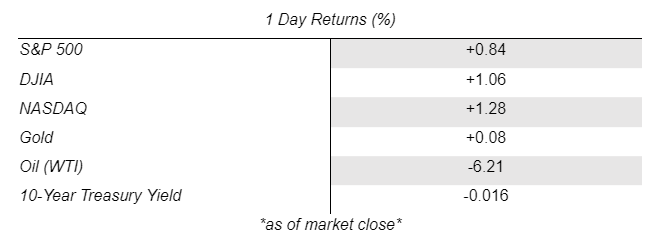

Good day for the markets

February 8, 2022 played out well for the three major indexes as they all closed the day with approximately 1% growth. This bodes well for the recent recovery in the market as investors await for the forthcoming rise in interest rates. The Fed announced in late January that due to the high inflation rate of over 2%, it would raise the interest rates in March. Consequently, the markets began to rise, and we have continued to see the major indexes experience consistent growth. This effect on American markets has spread around the globe, and especially in Asia, the major indexes have mirrored domestic growth. These markets, as well as investors at home await for this Thursday’s release of inflation data

U.S. Economy & Drugs

The US faces unprecedented loss in opioid related deaths

The U.S. Commission on Combating Synthetic Opioid Trafficking has released their report on opioid overdose deaths, and it has found that last year the number of fatalities was 100,000 Americans. This number of deaths was a 30% increase from the previous year. Experts have calculated that these drug overdose deaths are costing the United States $1 trillion dollars every year. This staggering number arises from the lost productivity of the people that pass, along with any costs associated with health care and enacting any subsequent criminal justice. The number of drug overdoses has been rising steadily since the early 2000s, and President Biden has declared the illicit drug trade a national emergency.

Facebook closes at lowest market valuation since May 2020

Facebook’s market cap closed the day by falling to $599.32 billion, the lowest it has been since May 2020. While this was a loss of 2.1%, such a drop in the market cap of Facebook will potentially benefit the company rather than indicate a downward trend in stock value. The company is currently under an antitrust lawsuit against its acquisition of WhatsApp and Instagram. This drop in valuation might actually help Facebook with this lawsuit and future business dealings. It coincidentally happens that House legislators chose $600 billion as the minimum market cap value for a company to be included in a set of potential bills that target big technology companies. By falling below this figure, Facebook might find some pressure relieved from their current lawsuit and less scrutiny from the Federal Trade Commission. While this might seem good for Facebook, other senate bills have proposed a minimum market value figure of $550 billion along with a clause that allows companies that dip below the minimum value to still be targeted by such bills.

Social Security

Social Security is on track to cut benefits by 2034

A recent report by the Social Security Trustees found that benefits of retirees will be cut to 78% of expected value in 2034. This will result in over 50 million retired workers not receiving the promised benefits that they have paid into Social Security throughout their life. Social Security hasn’t had a deficit since 1983, and this deficit was quickly overturned through bipartisan legislation. Today’s political sphere also requires a bipartisan agreement and new legislation to fix the funding for Social Security. The two main methods that Congress might use to properly fund this program are to either cut benefits now or increase the retirement age, or to increase tax revenue by increasing the tax rate or increasing the maximum tax amount of $147,000. Such methods seem drastic but are needed to fix the funding issue; unfortunately, given the length of time between present day and the expected date that benefits will be cut, it is unlikely that Congress will act on this issue.

Works Cited

“Asian Markets Rise as Investors Await U.S. Inflation Data.” MarketWatch, MarketWatch, 8 Feb. 2022, https://www.marketwatch.com/story/asian-markets-rise-as-investors-await-u-s-inflation-data-01644380975.

Cox, Jeff. “Federal Reserve Points to Interest Rate Hike Coming in March.” CNBC, CNBC, 26 Jan. 2022, https://www.cnbc.com/2022/01/26/fed-decision-january-2022-.html.

Feiner, Lauren. “Facebook Market Cap Falls below $600 Billion - Which Could Actually Help It Dodge New Antitrust Scrutiny.” CNBC, CNBC, 8 Feb. 2022, https://www.cnbc.com/2022/02/08/facebook-market-cap-under-600-billion-threshold-for-antitrust-bills.html.

Langley, Karen, and Will Horner. “Bond Yields, Stocks Rise amid Earnings.” The Wall Street Journal, Dow Jones & Company, 8 Feb. 2022, https://www.wsj.com/articles/global-stocks-markets-dow-update-02-08-2022-11644309070.

Taylor, Chloe. “Drug Overdoses Are Costing the U.S. Economy $1 Trillion a Year, Government Report Estimates.” CNBC, CNBC, 8 Feb. 2022, https://www.cnbc.com/2022/02/08/drug-overdoses-cost-the-us-around-1-trillion-a-year-report-says.html.